Congress Moves to Shield Gig Worker Tips From IRS Reporting

The question hitting 70 million gig workers right now is straightforward: are DoorDash tips taxed? The answer is yes - but that could be changing soon.

Congress is considering legislation that would exempt tips from federal income tax altogether, a move backed by major platforms like Uber, Instacart, and DoorDash. The timing isn't coincidental. The IRS's controversial $600 reporting threshold has pushed digital tip taxation into the spotlight, affecting millions of Americans who earn income outside traditional employment relationships.

Here's what makes this particularly interesting - the current $600 threshold represents a dramatic drop from the previous requirement of $20,000 and 200 transactions. If that threshold were adjusted for inflation, it would sit closer to $7,000 today. That disconnect suggests the system hasn't kept pace with economic reality.

I think this debate captures something bigger than just tip taxation. It's really about whether our tax code can adapt to how people actually work now. The Joint Committee on Taxation estimates the reporting change could generate over $8 billion in new tax revenue over the next decade - significant money for the government, but also a substantial burden for Americans relying on gig work to manage inflation pressures.

The stakes here aren't just financial. They're about whether we treat a restaurant server differently than a food delivery driver performing similar work, and whether tips should face the same tax treatment regardless of how someone earns them.

Congress Proposes Exemption for Gig Worker Tips

Image Source: Forbes

The momentum behind tip exemptions is building on both sides of the aisle. Last month, the House passed a domestic spending bill with provisions creating tax breaks for tipped workers across multiple industries. The Senate followed with unanimous approval of its own "No Tax on Tips Act" - rare bipartisan agreement on tax policy in today's environment.

What the new legislation aims to change

The core mechanism is straightforward: tip income would become exempt from federal income taxes. Tips get subtracted from reported income as an "above the line" deduction, effectively reducing the tax owed. The exemption runs from 2026 through 2028, making it a temporary fix rather than permanent policy.

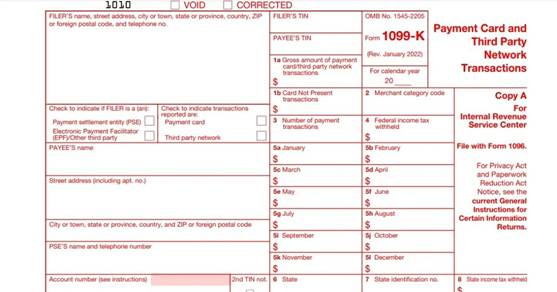

The House version tackles more than just tip exemptions. It would increase the 1099-MISC reporting threshold from $600 to $2,000 for payments to independent contractors, reducing paperwork burdens on small businesses. More significantly, the bill would repeal the controversial ARPA 1099-K rule that forced reporting requirements on payment app users for transactions as low as $600.

The Joint Committee on Taxation data here is telling: without intervention, Americans making less than $200,000 would bear over 90 percent of the tax burden from these reporting requirements. That suggests the current system disproportionately hits middle and lower-income earners.

Which workers are covered under the proposal

Here's where it gets interesting - the House and Senate versions diverge significantly on scope. Both target workers in "traditionally and customarily tipped industries", covering restaurant servers, baristas, food delivery drivers, and anyone receiving tips after selling food. We're talking about more than two million tipped restaurant workers nationwide.

The key difference lies in how they handle gig workers. The House bill includes "independent contractors," which means app-based delivery drivers for DoorDash and Uber would qualify. These drivers would be freed from reporting billions in tips as taxable income. The Senate version takes a narrower approach, covering only traditional employees in hotel, beauty, beverage, food service, and pizza delivery sectors.

Both bills set an income cap - workers must earn less than $160,000 in 2025 to qualify for the deduction. If the House version prevails, many DoorDash drivers wondering about tip taxation could soon see their answer change from "yes" to "no."

The Yale Budget Lab estimates roughly 4 million tipped workers - about 2.5% of the total working population - would benefit from eliminating taxes on tips. That's a significant constituency, but the real question is which version of coverage will ultimately pass.

IRS $600 Rule Faces Repeal Pressure

Image Source: Accounting Today

The IRS finds itself caught between policy ambition and practical reality. The agency's attempt to cast a wider tax collection net through lowered reporting thresholds has created more problems than solutions, and the backlash is building momentum.

How the 1099-K threshold evolved

The transformation here is pretty dramatic when you look at the numbers. Prior to 2021, third-party payment processors like PayPal and Venmo only issued 1099-K forms to users who exceeded $20,000 in sales and completed more than 200 transactions within a calendar year. That seemed reasonable enough - it captured serious commercial activity while leaving casual transactions alone.

Then the American Rescue Plan Act slashed the threshold to just $600, regardless of transaction volume. The immediate pushback was so intense that the IRS had to retreat into a phased implementation. For 2024, the reporting threshold sits at $5,000 with no minimum transaction requirement. It drops to $2,500 in 2025, before reaching the statutory $600 threshold in 2026.

This phased approach tells you everything about how poorly the original plan was received.

Why the $600 rule sparked backlash

The problem isn't just the lower threshold - it's the scope of what gets swept up in the process. Critics correctly pointed out that casual online sellers who occasionally sell personal items at a loss would suddenly find themselves dealing with tax forms for transactions that aren't even taxable.

The National Association of Tax Professionals called the requirement "overly burdensome," warning it would create "undue issues for taxpayers" while further overwhelming an already backlogged IRS. When approximately 44 million Americans were estimated to receive a 1099 form under the lowered threshold, you're talking about a massive administrative burden that falls disproportionately on taxpayers making less than $200,000 - over 90 percent of the tax burden.

Are Uber and DoorDash tips taxable under current law?

Right now, absolutely. Tips received through platforms like Uber and DoorDash count as taxable income, and that's a significant issue when food delivery drivers earn approximately 53.4% of their income from tips.

DoorDash has been particularly vocal about this, arguing through their DashRoots Advocacy Network that independent contractors working with app-based platforms deserve the same tax breaks as other tipped workers. Their position is simple: "tips are tips" regardless of how people work.

The company has mobilized thousands of drivers to contact lawmakers, and it's not hard to see why. When digital payments create a paper trail that cash tips don't have, gig workers face a compliance reality that traditional tipped employees can sometimes avoid.

Experts Warn of Compliance and Revenue Tradeoffs

Image Source: Cato Institute

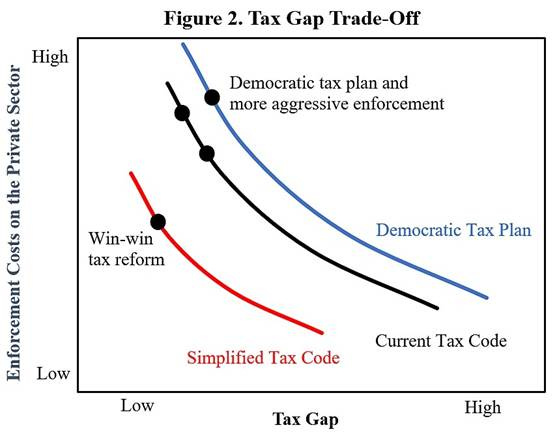

Tax experts aren't exactly thrilled about the tip exemption proposals. They're pointing to some serious tradeoffs between making life easier for workers and the government's ability to actually collect taxes.

The Government Accountability Office identified significant gaps in the current system that create problems on both sides - workers struggle with compliance while the IRS faces enforcement headaches. It's a cycle that doesn't seem to be getting better on its own.

IRS Capacity Concerns and Data Overload

The IRS is already drowning in data management requirements. Despite mounting pressure, the agency can't even commit to implementation dates for guidance on voluntary withholding programs. That's not the only problem. The GAO found that platform workers often don't get adequate information about their earnings, which creates a noncompliance cycle that further strains IRS resources. When workers can't figure out what they owe, the system breaks down pretty quickly.

Tax Foundation's View on Enforcement vs. Burden

The Tax Foundation takes a measured approach to this mess. They emphasize that fixing compliance issues requires "policy reform and educational efforts are tools that reinforce one another, helping taxpayers fulfill their tax obligations while encouraging greater trust in the tax system".

The reality is more complicated. Properly tracking and deducting expenses remains a recurring challenge for gig workers receiving tips through platforms like DoorDash. Tax experts have suggested potential reforms including simplified expense deductions and voluntary withholding arrangements that would eliminate quarterly estimated payments. The catch? These measures "are not permitted under current tax and labor law".

How Much Revenue Is Really At Stake?

Here's where things get interesting from a numbers perspective. Back in 2006, the compliance rate for tips was estimated at only 48%, with underreported tips accounting for about 10% of the individual income tax underreporting gap. Recent trends suggest compliance has improved as digital payments replace cash transactions, but we're still talking about substantial money.

Experts warn that exempting tips would "forfeit substantial revenue" while potentially creating unintended consequences. The exemption could lead to "the spread of tipping to industries in which it is not common," with the exempted portion of income potentially averaging "between 20 and 40 percent".

I think the real question here is whether the compliance improvements from digital payments offset the revenue loss from exemptions. The answer probably depends on how broadly tipping spreads to other industries if tips become tax-free.

Gig Platforms Rally Behind Tip Exemption

Image Source: Washington Times

The gig economy represents nearly 60 million Americans, and the platforms serving them have mobilized that constituency into a powerful lobbying force behind the No Tax on Tips legislation. What's interesting here is how companies like Uber, DoorDash, and Instacart have framed this as a fundamental fairness issue rather than just another tax break.

The Corporate Push Gets Coordinated

Uber CEO Dara Khosrowshahi publicly endorsed the No Tax on Tips provision, thanking both President Trump and Representative Jason Smith for "backing all tipped workers no matter how they work". DoorDash went further - co-founder Tony Xu reported that approximately 40,000 DoorDash drivers directly contacted lawmakers to push for a "tax break on their hard-earned tips".

The coordination extends beyond individual company efforts. TechNet, a bipartisan network of technology executives, formally urged Congress to include gig workers in any tip exemption legislation, emphasizing that gig workers "are not just a convenience—they are essential to the American economy".

Why Digital Tips Create a Different Dynamic

The platforms argue for equal treatment, but there's a strategic element worth noting. Unlike cash tips that traditional service workers might receive, digital tips create a paper trail that makes tax avoidance nearly impossible. Uber stated it's "only fair that you be treated the same—no matter how you work", but the reality is that gig workers face more systematic tax compliance than their cash-tip counterparts.

The House Ways & Means Committee version includes independent earners like Uber drivers and couriers. If approved, tips reported to the IRS on 1099 forms would generally become exempt from federal income tax. That's a significant shift for an industry where digital documentation makes every transaction visible to tax authorities.

The Current Tax Reality for App-Based Tips

Right now, all tips received through apps like DoorDash are taxable income. DoorDash issues 1099 forms to drivers earning $600 or more annually, including app-based tips. Even drivers below this threshold must legally report and pay taxes on tip income.

The documentation difference is stark - digital tips are thoroughly tracked and reported to the IRS, making compliance unavoidable for gig workers. Traditional cash tips, by contrast, rely more heavily on worker self-reporting. The proposed legislation would level that playing field, potentially giving millions of delivery drivers and rideshare operators the same practical tax treatment that cash-tip workers already enjoy.

The Bottom Line on Gig Worker Tip Taxation

Congress appears headed toward some version of tip exemption, though the final details remain uncertain. The bipartisan momentum suggests this isn't just political theater - lawmakers seem genuinely convinced that the current system doesn't work for how people actually earn money today.

I think the most telling aspect of this debate is how it exposes the disconnect between our tax code and economic reality. When you have 70 million Americans working in arrangements that didn't exist when these rules were written, something has to give. The question isn't really whether change is coming - it's what that change looks like.

The revenue concerns raised by tax experts are legitimate, but they miss a crucial point. The current system already struggles with compliance, particularly around cash tips that go unreported. Digital tips are actually easier to track and tax than traditional cash tips ever were. If anything, the move toward app-based tipping has probably improved overall compliance rates.

What's really at stake here is whether we treat similar work similarly. A restaurant server and a DoorDash driver are both providing service in exchange for tips. The difference is that one works through an app and the other works through a traditional employer relationship. Does that distinction justify different tax treatment? I don't think it does.

The platforms have clearly decided this is a hill worth fighting on. They're mobilizing drivers, lobbying lawmakers, and framing this as a fairness issue. That suggests they see tip taxation as a real competitive disadvantage in attracting and retaining workers.

Looking ahead, I expect we'll see some version of tip exemption become law, probably with income limits and perhaps a sunset provision. The specifics matter less than the principle - that tips should be treated as tips regardless of how they're earned or delivered.

The broader implications could be significant. If this passes, it might accelerate the shift toward tip-based compensation models across industries. It could also set a precedent for treating gig work differently from traditional employment in other areas of tax policy.

For the millions of Americans currently navigating the gig economy, the potential relief is real. Whether it's the right policy choice for the tax system as a whole remains to be seen.

The Free Markets Report is provided by Lead-Lag Publishing, LLC. All opinions and views mentioned in this report constitute our judgments as of the date of writing and are subject to change at any time. Information within this material is not intended to be used as a primary basis for investment decisions, and should also not be construed as advice meeting the particular investment needs of any individual investor. Trading signals produced by The Free Markets Report are independent of other services provided by Lead-Lag Publishing, LLC, or its affiliates, and the positioning of accounts under their management may differ. Please remember that investing involves risk, including loss of principal, and past performance may not be indicative of future results. Lead-Lag Publishing, LLC, its members, officers, directors, and employees expressly disclaim all liability with respect to actions taken based on any or all of the information in this writing.