How Deregulation and Tariffs Are Shaping America’s New Economic Strategy

For decades following the Second World War, the United States led the charge to establish a liberal international order that put the US at the center of global trade and made the US dollar the global reserve currency. That order was underpinned by one key fact – that the United States was the overwhelmingly superior superpower, both economically and militarily, in a unipolar world – and brought immense benefits to the country.

However, the world of the 40s was vastly different from the world of today. Today’s world is multipolar, with China increasingly asserting its rise, multilateral organizations like BRICS planning the demise of the US dollar as the global reserve currency, and global trade heavily tilted against the US in terms of dollar flow.

The return of Donald Trump to the White House has marked a significant turning point in the US economic policy. He believes that the very liberal order that the US created is now haunting it, and by embracing wanton globalization, his predecessors effectively ignored the dangers it brought to the country. Therefore, in sharp contrast to the globalist and regulatory-heavy approaches of previous administrations, Trump’s second term embraces a bold vision rooted in economic nationalism.

At the heart of Trump’s agenda are two powerful levers: sweeping deregulation to liberate businesses from the ever-tightening talons of federal oversight and implementing tariffs to protect domestic industries from foreign competition. The objective is to restore America’s industrial might, accelerate domestic production, and reestablish US dominance on the global stage.

Tariffs and Deregulation: A Dual Engine of Economic Nationalism

Tariffs are taxes imposed by one country on the goods and services imported from another country. They are designed to readjust trade relationships by making foreign goods more expensive, thereby encouraging domestic consumers to buy the more cost-efficient local products and boosting domestic production.

Deregulation, on the other hand, seeks to reduce the cost and complexity of conducting business. By reducing environmental, labor, and financial regulations, governments can help companies save significant money to direct it elsewhere, such as expansion, capital expenditures, or research and development. Deregulation, thus, helps forge an agile and competitive economic environment and can potentially put the economy on a growth trajectory.

At first glance, tariffs and deregulation may seem at odds – tariffs are effectively an act of government intervention, while deregulation aims to reduce governmental interference in business.

However, in Trump’s economic worldview, they are not contradictory forces but rather complimentary tools. He views the US economy as having been undermined by unfair trade practices and excessive regulation. Together, tariffs and deregulation make a unified strategy aimed at reviving domestic industry: protecting it from foreign competitions while creating fertile grounds for growth through reducing regulatory barriers.

A Renewed Deregulatory Push

Deregulation was the central theme of Trump’s first administration and is more so under his second term. The President made his disdain for excessive regulation clear right at the outset of his second term by signing an executive order, called the "one-in, ten-out" rule, which calls for the elimination of ten regulations for every new one introduced.

Energy and environmental regulations are among the first targets. For instance, the administration has shuttered 34 regional branches of the Mine Safety and Health Administration (MSHA) and indicated plans to open previously protected federal lands, such as parts of the Arctic National Wildlife Refuge (ANWR), for oil and gas exploration, to increase drilling activities and energy production massively.

Likewise, the administration is also targeting reduced oversight at major regulatory agencies such as the Consumer Financial Protection Bureau (CFPB), Environment Protection Agency (EPA), and the Securities and Exchange Commission (SEC). Toward this end, the new Trump administration has appointed Elon Musk to lead the restructuring of federal regulatory agencies under the auspices of the newly created Department of Government Efficiency (DOGE), which has been significantly empowered to conduct a sweeping overhaul of the US government and bureaucracy.

Other key deregulatory initiatives include expedited approvals for energy projects to boost domestic production; rollbacks on labor protections, tilting power in favor of employers; and reevaluation of antitrust enforcement, signifying potential leniency toward big corporate mergers and acquisitions.

These actions signify Trump’s disdain for bureaucratic red tape and his commitment to minimizing federal intervention in economic matters to slash compliance costs, attract investment, and enhance the global competitiveness of US businesses.

Trump’s Tariff Doctrine

On the trade front, Trump’s tariff strategy is rooted in the idea of sheer economic independence achieved through the revival of domestic manufacturing and other critical industries.

The official chargesheet on the White House website points to persistent trade deficits as the root cause of the US manufacturing decline. The website also highlights the critical supply chain vulnerabilities facing the country, leaving it exposed to significant national security risks. It underscores that in 2001, the US accounted for 28.4% of global manufacturing output, which by 2023 had plunged to 17.4%, with the decline being most evident in advanced industries such as autos, pharmaceuticals, and microelectronics – sectors considered critically essential to both economic and national security.

To combat this, the Trump administration invoked the International Emergency Economic Powers Act (IEEPA) at the start of April 2025 to impose a universal 10% tariff on all imports. In addition, reciprocal tariffs – much higher than 10% – have been applied to countries with which the US runs the largest trade deficits. These measures aim to fix the imbalances resulting from the protectionist policies of other countries, such as currency manipulation, excessive tariffs on US products entering their territory, and other restrictive trade practices targeting US products.

Supporters of these measures point to economic projections. A 2024 forecast estimated that a 10% global tariff could grow US GDP by $728 billion, create 2.8 million jobs, and increase real household incomes by 5.7%.

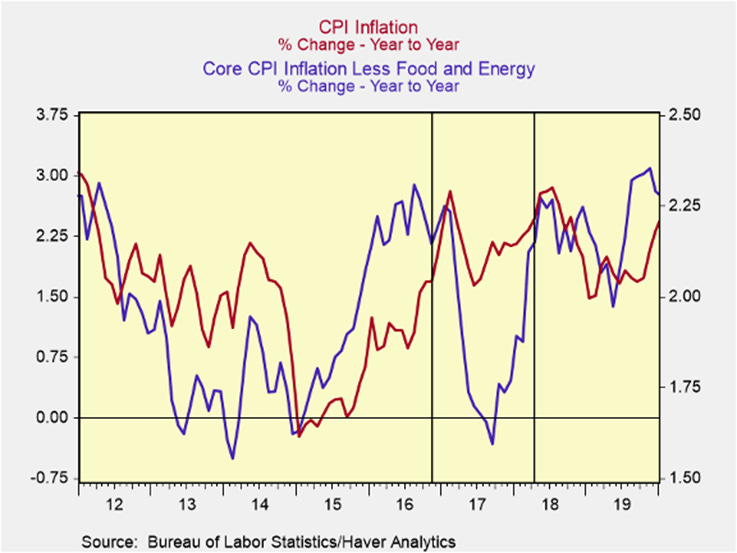

Critics object that these measures will increase inflation, which has already burdened the US consumer. However, it is interesting to note that US CPI inflation and core CPI inflation actually receded after the imposition of tariffs under the first Trump administration (see the chart below).

Asymmetrical Impact and Strategic Leverage

Much has been written and said about the follies of protectionism that the second Trump administration has espoused. While only time will reveal the actual impact of these claims, it is important to view Trump's trade stance through a broader strategic lens.

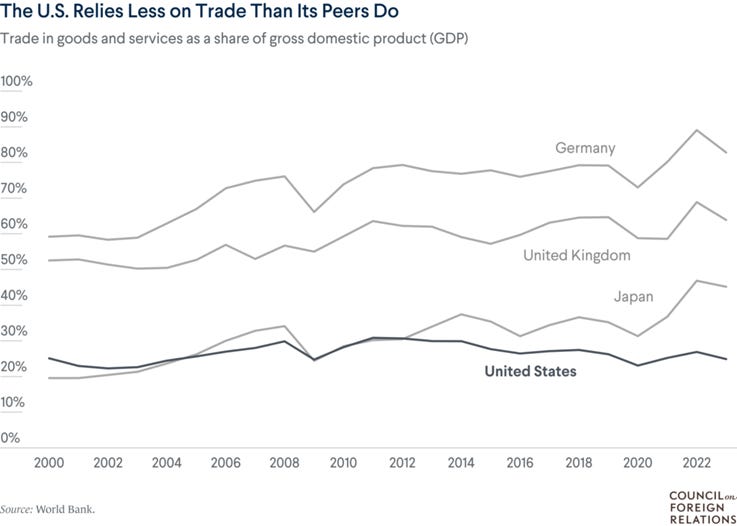

At present, trade makes only a quarter of the US GDP. That means the US is less dependent on trade and less vulnerable to trade disruptions than its peers in the region and beyond.

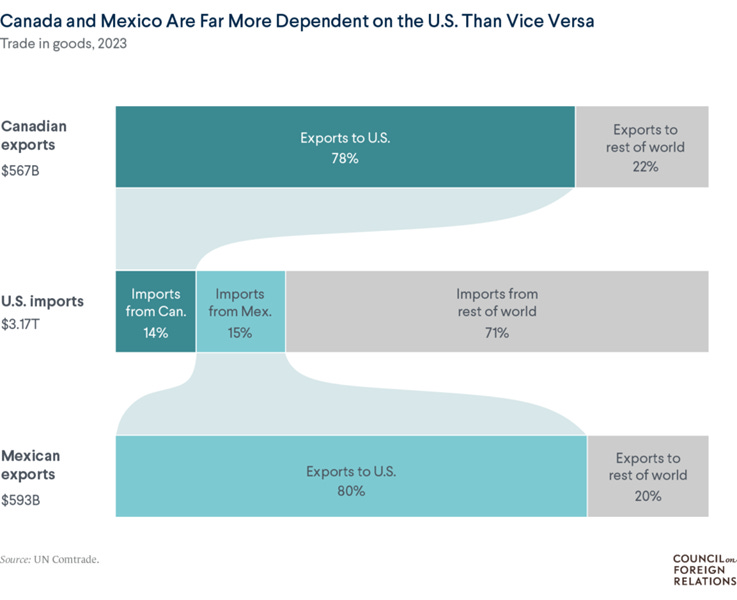

Take the example of Canada and Mexico. Trade represents over 70% of GDP for export-heavy economies of Canada and Mexico, with the US being their predominant trading partner.

Mexico is especially exposed. Almost 80% of its exports, including electronics, cars, and medical equipment, go to the US, amounting to more than $200 billion annually. Analysts warn that a unilateral tariff of 25% could shrink Mexico’s GDP by up to 16%, obliterating sectors like auto manufacturing.

Likewise, the US buys over 70% of Canada’s exports, and over 80% of Canada’s oil is shipped south annually. Similar patterns emerge for several other countries with which the US conducts trade.

This highlights that the US is way more secure than its peers against potential disruptions in global trade. It is very likely that the new Trump administration views tariffs as a powerful negotiating tool to realign America's trade imbalance with the rest of the world once and for all.

How Deregulation and Tariffs Reinforce Each Other

Trump’s policies around governmental oversight and trade are not standalone but strategically intertwined.

Tariffs protect US industries by making imports more expensive and less competitive, encouraging consumers and businesses to buy American. At the same time, deregulation slashes compliance costs, making it cheaper and easier for US businesses to invest, expand, thrive, and compete globally. The combination creates a potent pro-business environment for US businesses, where they can scale fast, reinvest locally, and grow rapidly.

The beneficiaries of this approach will include heavy manufacturers, energy producers, domestic suppliers, and emerging sectors such as AI and advanced tech, all of whom stand to gain from relaxed oversight, tariff shields, and more capital for reinvestment and growth.

The Free Markets Report is provided by Lead-Lag Publishing, LLC. All opinions and views mentioned in this report constitute our judgments as of the date of writing and are subject to change at any time. Information within this material is not intended to be used as a primary basis for investment decisions, and should also not be construed as advice meeting the particular investment needs of any individual investor. Trading signals produced by The Free Markets Report are independent of other services provided by Lead-Lag Publishing, LLC, or its affiliates, and the positioning of accounts under their management may differ. Please remember that investing involves risk, including loss of principal, and past performance may not be indicative of future results. Lead-Lag Publishing, LLC, its members, officers, directors, and employees expressly disclaim all liability with respect to actions taken based on any or all of the information in this writing.