VVV: Historical Automotive Giant to Win Big

Valvoline Inc. is an automotive services company that has been producing and distributing automotive lubricants since 1866. It operates and franchises service centers and retail stores across the United States and Canada, with more than 2000 centers under its banner. Valvoline has a proud history as the leader in automotive vehicle service industry.

The U.S. has been quietly dominant in the international energy space over the last five years. No country extracted as much oil over this period or exported as much. Perhaps the fact that many still consider Saudi Arabia the world’s biggest oil producer informs President Donald Trump’s energy policy.

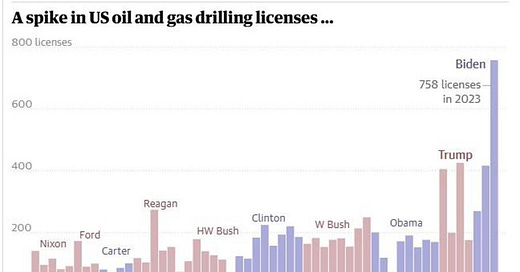

In the last five years, America’s oil and gas industry has been supercharged by among other things, the heavy investment in production infrastructure, increased product demand and increased government good support. We can all agree that both Biden and Trump administrations have previously backed increased exploration, noting that a relatively huge number of private companies obtained drilling licenses during President Biden’s term.

As for Trump’s first era, there was an additional boost to the increase, as we saw a very aggressive reversal of related policies including and not limited to climate-focused policies and availing more land for exploration.

Oil Drilling Licenses Obtained Over the Years: https://www.theguardian.com/environment/article/2024/jul/24/fossil-fuel-liquified-natural-gas-louisiana

Drill, Baby, Drill

The gas and oil industry has done well under all the four previous administrations. Beyond the dip caused by the coronavirus pandemic, production has been soaring, and exports have elevated the U.S. well beyond other oil producers internationally.

While Biden’s administration saw a sharp growth, it also introduced many of the regulations Trump will look to overturn. To start with players in the energy industry weren’t so happy with Biden’s climate friendly policies as they challenged their operations. On the other hand, President Trump has always been vocal in regards to the importance of exploring fossil fuels to the maximum as it forms the backbone of the country’s economy. A major reason why the companies including Valvoline Inc. are setting themselves up to capitalize fully on the win.

President Trump’s January 2025 executive orders reinforced his commitment to U.S. energy independence. “Unleashing American Energy” is geared towards increasing domestic gas and oil exploration. From this, we anticipate to see among other things the following:

Lifting the ban on previously protected federal lands and waters.

Greater support for hydraulic fracking which will encourage operators to increase production activity and output.

Dropping stringent green energy policies and requirements like methane emission regulations will lower the burden on companies.

Making the drilling licensure process easier.

Eliminating the pre-requisites and compliance standards for environmental impact assessments for companies.

Reviving stalled gas and oil production projects and improving transportation infrastructure, further enabling the environment for the industry players.

The opportunity for Valvoline Inc.

Early reactions to Trump’s economic agenda have been mixed. Investors and players in the energy sector anticipate a better working environment; indeed, many pegged their support of his campaign on the promise that he would be friendlier to businesses in manufacturing, gas and oil. Over the years, Valvoline’s stocks have steadily grown with the company posting a 11% sales growth rate year after year, which is commendable.

Valvoline’s revenue for the last quarter was $820 million. With the company’s ambitious plans for expansion, as well as the gradual implementation of favourable government policies, the revenue will go up in 2025. Valvoline’s net earnings grew 177% year-over-year to $94 million.

Valvoline Stock Performance: https://finance.yahoo.com/quote/VVV/chart

Valvoline stock has increased 10.83% over the past year. The company increased its full-year EPS forecast to $1.57-$1.67 (vs. the $1.62 consensus) and maintained a $1.7 billion revenue guidance.

An early result of Trump’s deregulation will likely be the spike in demand for gas and oil, which will lead to an increase in its production. Companies that rely on production equipment and services like those offered by Valvoline are therefore going to win, at least in the short-term. Trump’s policies are also geared towards removing red-tape, which means Valvoline will be able to operate more efficiently.

There is also a high probability that Trump oversees a return to oil-based engines. He walked back a 2021 executive order (working towards nationwide adoption of electric cars in pursuit of a green America). Valvoline can take advantage of this to widen its market share and increase its profits.

It is a solid investment in the short-term and a good candidate for unlimited growth over the next 4 years.

The Free Markets Report is provided by Lead-Lag Publishing, LLC. All opinions and views mentioned in this report constitute our judgments as of the date of writing and are subject to change at any time. Information within this material is not intended to be used as a primary basis for investment decisions, and should also not be construed as advice meeting the particular investment needs of any individual investor. Trading signals produced by The Free Markets Report are independent of other services provided by Lead-Lag Publishing, LLC, or its affiliates, and the positioning of accounts under their management may differ. Please remember that investing involves risk, including loss of principal, and past performance may not be indicative of future results. Lead-Lag Publishing, LLC, its members, officers, directors, and employees expressly disclaim all liability with respect to actions taken based on any or all of the information in this writing.